Debt Recovery in 2019: Innovation in challenging times

- November 5, 2019

- Category: Compliance Management

Recommended Reading

With rapidly-shifting technology, regulations, and demographics, the collections industry is changing like never before. In today’s highly-mobile society, debtors want solutions that are rapid, accessible, and easy to use.

Which brings us to our first question: Are you doing something like mailing documents to your debtors when a simple e-sign would do?

The current scenario demands change, and for an industry like ARM and collections — where technological adoption is generally sluggish — finding the right solution (and the team to manage it) becomes a headache.

Here’s a list of challenges that the industry faces in the coming years, and some ways on how to tackle them for a better 2020!

The challenges with debt recovery in 2019

1. Hiring amidst historically low unemployment rates

As of March 2019, the unemployment rate in the USA was at its lowest — 3.8%. For those who are aware of the opportunities and challenges this metric represents, this is way less than the “natural” rate of employment.

Experts time and again have tried and explain how a certain rate of unemployment is, in fact, healthy for the industry. To put it simply, a healthy rate of unemployment leads to skilled professionals going out and taking new jobs. This, in turn, allows companies to find new talent and even boost overall productivity across different operations of their business.

Going with that logic, businesses that offer challenging job profiles such as in Debt Collection are in a tough spot amidst historically low unemployment rates. Because the debt recovery companies are unable to find enough workers, they are finding it hard to even get existing jobs done, let alone the next steps of boosting productivity and hence profitability.

What’s the solution?

Consider a combination of automation and offshoring to more labor-effective geographies. Leveraging technology should be your first preference — automation is here to stay, so utilize it to reduce the mundane, repetitive tasks from your agents’ to-do lists so that they can focus their energies on more interesting, nuanced challenges.

What can’t be automated — consider offshoring. You have the potential to reduce costs by at least 35% — and with a trusted partner, find the perfect balance between quality, costs, and control.

2. Too Many Calls and Emails, But Not Enough Communication

One of the biggest challenges in this space is a lot of interactions, but not enough effective communication. This is largely due to inefficient communication technologies that delay the transaction — even when the debtor is ready to pay. A large chunk of communication happens through snail mail or email today — while SMS or live chat might be a much faster way to resolve questions, and providing a self-service mobile option can significantly reduce tying up collectors’ time with repetitive inbound questions.

Law firms and agencies can no longer shy away from investing in better tools and awareness. The nature of debt collection is inherently nuanced and complicated — and sometimes the negotiation window, or the window of intent to pay, can be extremely short. To make the best use of this time, exchanging documents, getting signatures, sharing repayment plans, or calculations need to be instant. So when you require a payer to get documents printed or scanned — or worse, shipped by mail — consumer experience is ruined and inefficiency creeps in.

What’s the solution?

Technology

(Yes, there’s a pattern here.)

Consider using omnichannel self-service apps like IConnect247 that can provide white label solutions for the web and mobile. A lot of the routine transactions like exchanging documents in real-time, getting them signed off, checking a balance or even chat to negotiate further become much more convenient, hassle-free, and inexpensive.

3. In God we trust, but all others bring data

Data has been likened to the “oil” of the 21st century — and with good reason. One can’t truly overstate its importance in driving good decisions.

Unfortunately, many collection managers have shared how their current tools and systems are ill-equipped to gather and analyze quality management information. Even when they have data available to them, it’s often historic, which hampers the ability for them to use it for any actionable insight.

Another challenge with this data is that not every law firm or agency has the capital to invest in a business analytics dashboard or the IT resources to build one. This results in failure to convert data into actionable insights.

What’s the solution?

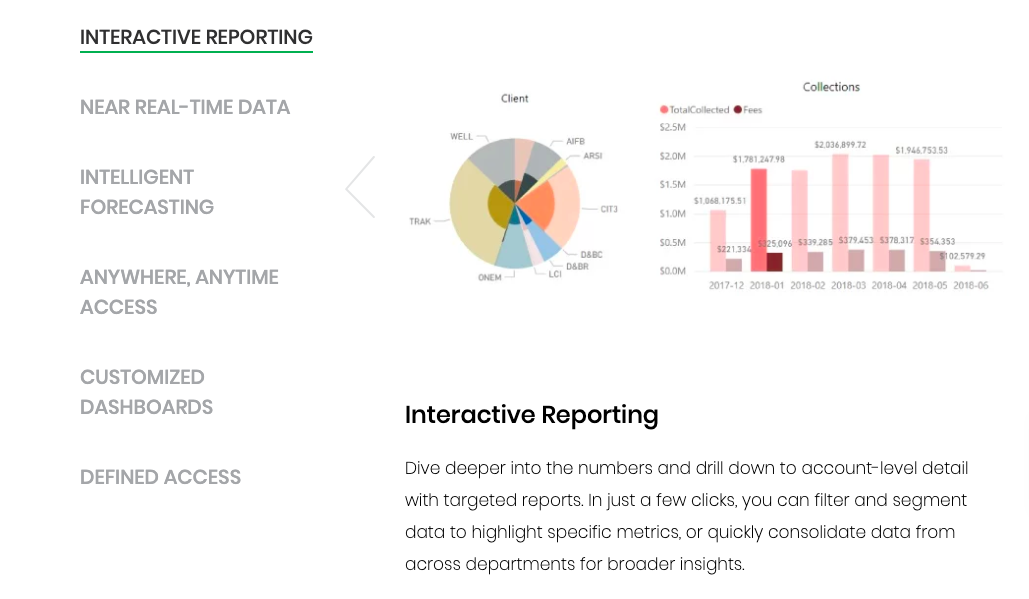

IDAP® bridges the gaps between your disparate reporting systems, presenting unified insights on a single dashboard. Built on Power-BI, easy to use, simple to implement and budget-friendly, IDAP® delivers the power of big data to any size business.

The best part?

While IDAP® is an advanced platform that performs complex tasks, implementing it is simple, often requiring two hours or less of your time. We handle management and maintenance, as well as ongoing analyst support, customization, and training.

Challenges in the debt recovery industry are unlikely to fade away all at once. And definitely not without going head-on to overcome them. Using the right technologies and practices, however, it can be a different story altogether. It’s only about who sees the challenge as an opportunity to drive growth, and who does not.