6 Must Do’s of Effective Dispute Management, including Tips on e-Oscar

- February 1, 2021

- Category: Dispute Management

Recommended Reading

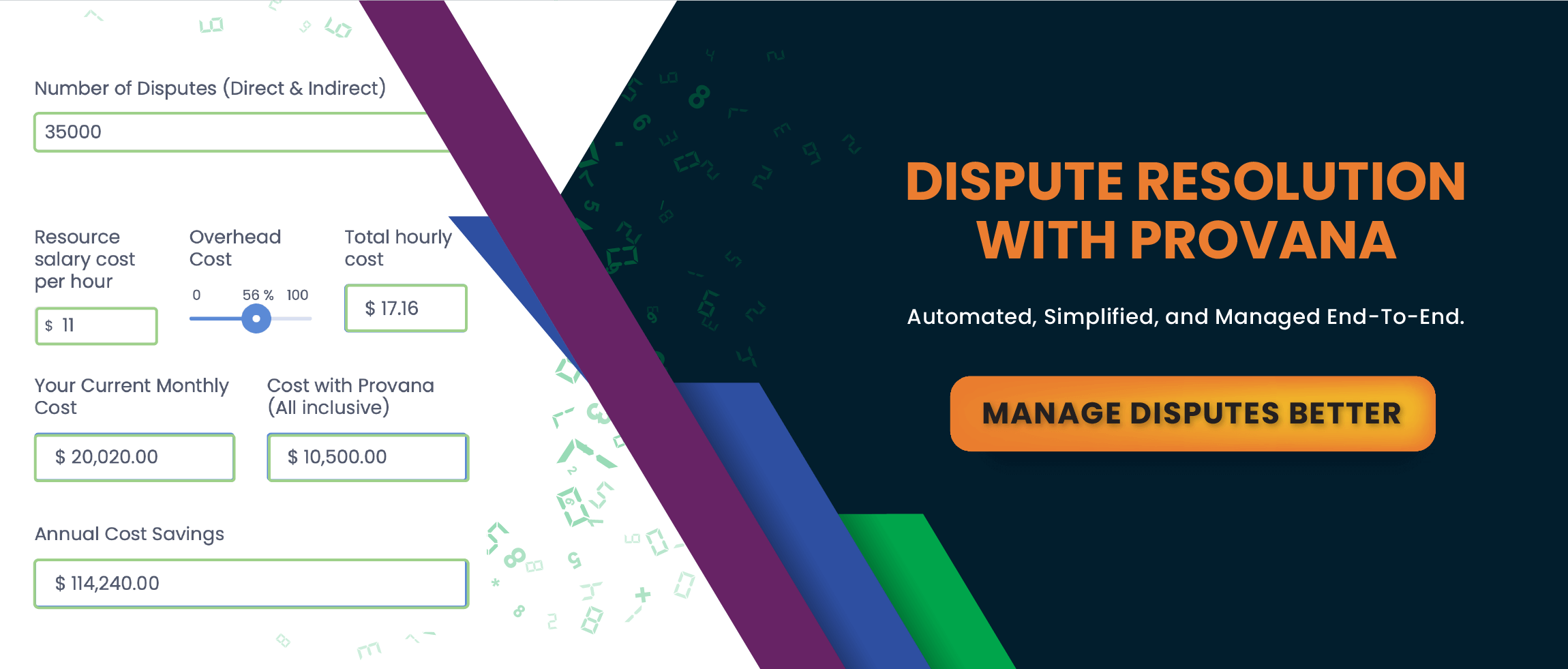

A report by Mercator Advisory Group estimated 33 million transactions to be disputed in the coming year. This means data furnishers will need to find ways to manage the ever-increasing volume against the backdrop of a rebounding economy. Managing direct and e-Oscar automated credit disputes is already a manpower-intensive, redundant, high-volume activity. Adding more case volume pressure doesn’t help, but make people working on them prone to a lot more human errors and incidents of burnouts.

If you are using legacy ERPs to resolve disputes, the chances are your dispute management process isn’t standardized and you have limited resourcefulness capabilities. The good news is that you can reduce your manual dispute efforts by almost 60% along with benefits of minimized risks of writing-off bad debts, less time and costs spent on manual dispute resolution, and lowered risks of negative customer experience. Read on as we introduce best practices that will help you adopt a completely hands-off approach to dispute management using a unique combination of automation and manpower.

1. Get e-OSCAR integrated into your existing Workflows.

Since the onset of the pandemic, it has become easy for consumers to check their credit reports digitally. This explains the increase in the number of digital disputes. Since cash is being used less more low-dollar transactions are ending up on cards, adopting efficient procedures and paying more attention to the integration of e-Oscar into your dispute management system has become an urgency.

A single interface showing information from the e-Oscar portal and your System of Record (SOR) can help you make your process twice more efficient. Not to mention, configurable rule-based automation suggesting responses for each attribute can help you achieve 100% automation of redundant disputes.

2. Using locally stored dispute management software? Consider switching to the cloud.

The solution for a post-pandemic era in a debt-heavy economy is the combination of efficiency, scale, and paradoxically, a human touch. This is why, in a regulated industry like credit and collections, investing in managed-SaaS technologies can give your compliance processes, especially dispute investigation and resolution, a significant boost in performance. SaaS-based dispute management software will also help you manage your direct and indirect (e-Oscar) disputes, integrated seamlessly with your existing ecosystem.

3. Get OCR-Based Indexing feature embedded into your dispute documentation system.

Look for ways to integrate Optical Character Recognition (OCR) capability into your existing dispute documentation to identify correct accounts with corresponding data. This should also help you automate the resolution based on the information provided. This particular feature should also help you classify the nature of the dispute instantly without skimming through paper.

4. Adopt a more centralized approach.

Traditional dispute resolution involves multiple departments just to trace the source of the dispute. This fragmented workflow process usually prevents a seamless inter-team collaboration, which in turn delays the resolution of the disputes. Centrally managing disputes with related documentation across channels like company website, emails, verbal, e-Oscar, etc. can help your business solve this problem. This way, collectors and dispute analysts can access and take action on disputes from a single place.

Tasks such as fetching data from multiple portals, to and from communication with clients for missing documents, gathering data from internal and external sources, make dispute resolution highly manual in nature. The volume of disputes can make it hard to keep track of additional material. A more streamlined, centralized approach, on the other hand, can help you establish an automated workflow once you receive additional information about a dispute.

5. Ensure more cohesiveness between teams.

The dispute management process generally involves the collections analysts recording customer-initiated disputes and validating them to accelerate resolution. But in large agencies, while collections and deductions teams function separately, they often collaborate to ensure faster dispute resolution and past-due recovery. To achieve this desired collaboration, you must spend time getting two teams to work together and get to know each other better. Offline activities in the workplace such as a collaborative brainstorming session on sampled problems can help you establish the right chemistry between teams.

6. Look for ways to automate the entire dispute lifecycle.

On average, around 15-20% of disputes are not valid and consume a high percentage of an analyst’s work time that could be used on other high-value tasks. In absence of automation and real-time tracking, collectors and analysts have to filter and search disputes for each consumer manually; As you can tell, this is time-consuming, which further delays past-due recovery. This means many labor hours and even additional costs to be borne by your business, and more importantly, writing-off unresolved disputes.

With IPACS® Dispute Management Solution, you can achieve desired automation and effectively view, manage, and strategize disputes related to missing or late payments, credits, or incorrect and disputed invoices. While it does help recover past-due on time, your communication and collections processes become more transparent, allowing you to interpret your cash flow and finances effectively.