Foreclosure Trends 2022: What Mortgage Default Servicing Firms Can Expect

- December 9, 2021

- Category: Compliance Management

Recommended Reading

As the CARES Act expires, mortgage default servicing law firms expect to see an uptick in foreclosures moving into 2022. Whether they’re considering business process management or technology-enabled solutions, this increase in activity brings the focus on compliance back to the forefront of the default servicing industry.

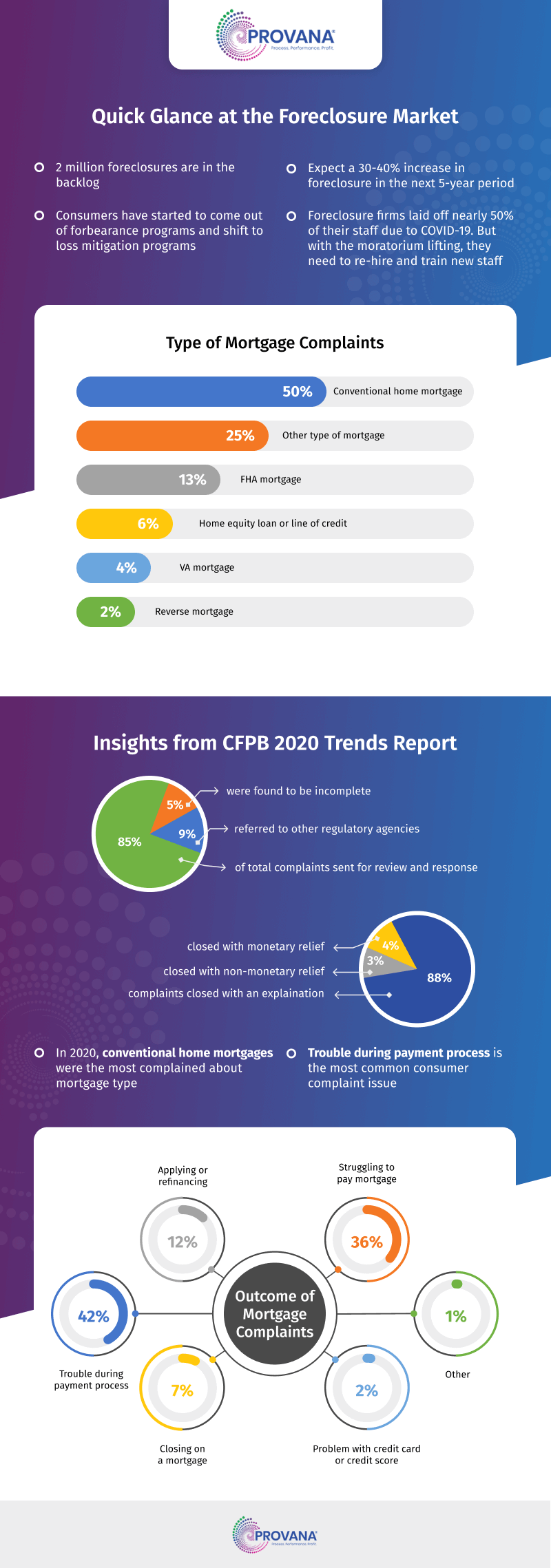

We recently analyzed foreclosure rate trends and CFPB data to summarize where the industry is heading in the infographic below:

Automated compliance management systems can help firms restart their operations quickly in the following scenarios:

- Conducting overall compliance training for new employees

- Managing employee certifications on new policies or procedures

- Centralizing all client documents in one place

- Keeping track of new client requirements and enforcing compliance

Especially beneficial is automated version control for policies and procedures, custom test schedules and in-platform testing. If you’re not sure where to begin, contact us, for a free consultation.