Increasing market share and profitability with technology [webinar]

- December 9, 2019

- Category: Compliance Management

Recommended Reading

Reducing costs, increasing efficiency, and building systems to scale the results. That’s more or less what any company needs to do when it comes to increasing its market share.

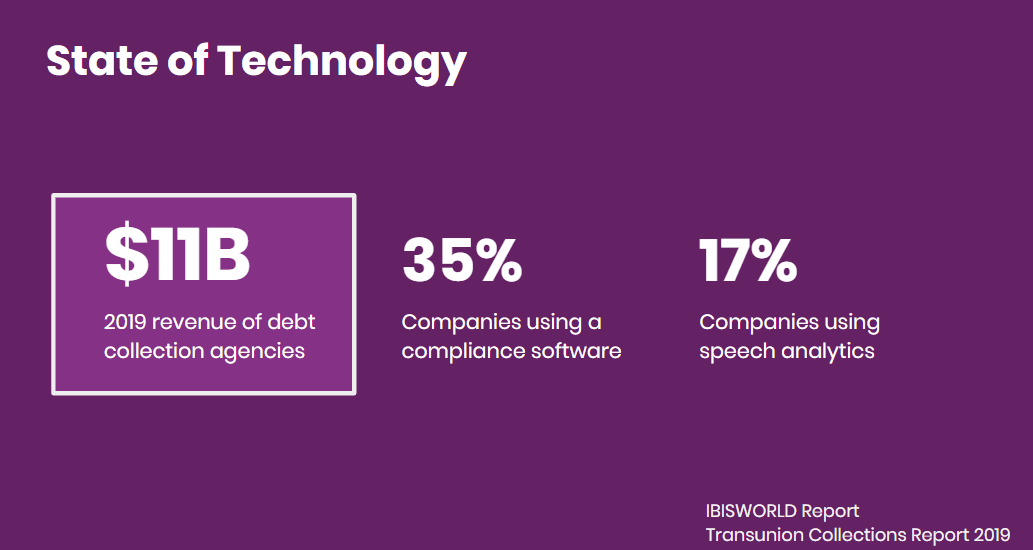

With just 35% of agencies using compliance management software and a mere 17% of them using speech analytics, the room of growth is massive. Identifying the gaps and bridging them with bleeding-edge technology will be key.

In our webinar with Sean Clark and John Bedard, these are a few of the items we discussed.

In this post, we are going to discuss the various pointers discussed by the panel in our webinar. So, folks who prefer relying on their reading speed than watching or listening – here we go:

1. Chipping inefficiencies away with effective document control.

To really minimize inefficiency at any collection firm, it is important to have total control over documentation. From access and version control to be able to index documents from various points of time, the road ahead needs a reliable and transparent document control for collection agencies to truly succeed at scale.

While implementing effective document control, it is important to understand that oversimplification can be a threat too. It’s true that you want to make documentation control as streamlined as possible. However, you would still need to make sure that the rule of access as per authorization for various procedures is still in play. Making sure that only relevant stakeholders are able to access a set of documents is at the core of implementing a successful document control program.

2. Increasing stakeholder participation by tracking the right KPIs.

Driving growth for your company would be a direct result of improved performance and productivity for all the stakeholders at your firm. To do this, the right way is to first identify the right KPIs.

Once these KPIs and their importance are established, it is important to find the right number for it. However, running after KPIs for the sake of it is not going to do much for you as well. The focus should be on the change from where you started.

The true potential of this exercise would be realized if and only if stakeholders from across the spectrum participate in this. Be it the agents/attorneys, floor managers, or training and compliance personnel, this exercise must be performed with every member of your team.

To magnify the impact, every team member must be having access to data in a tiered manner. Once a layered performance tracking and monitoring system is in place, the team members must be able to track their individual performance as well as those whom they are responsible for. This way, you will be able to assess the performance of various practices and tools that the agents on the floor are using.

3. Robust & Streamlined Compliance Management System.

Gone are the days when compliance was one of the unattended facets for companies. Today, customer expectations and increased regulatory oversight have become a great motivation for collection agencies to focus on compliance.

In a space as dynamic as the credit and collection industry, it is common for companies to put compliance in the backseat when they are after growth. Keeping growth as your only focus while mismanaging compliance is equivalent to putting the pedal to the metal while not bothering about airbags or brakes.

Constant complaints and disputes raised by the customers can really hinder your growth. To avoid this, the first step must be to make sure that these issues are documented well enough so that they can be resolved with prompt action. This is where an automated complaint management system proves to be extremely handy.

4. Taking it to the collection floors with training.

Amidst all the talk about productivity, it is important to identify the root cause of why the situation is far from ideal. In many cases, you must realize that by following a certain KPI, you can end up getting stuck in the endless unidirectional journey of incremental change. That is not the right way to grow.

Especially when it comes to agent performance, increased productivity and improved performance could just be a few training sessions away. Productivity issues with agents, invariably, spring up as a result of not being familiar enough with the tools and software they use. While interacting with a consumer, the agents need to access numerous data points.

To do this, the agent needs to interact with a number of tools and software. If the agent is not well-versed with these elements, the agent will invariably be inefficient. Come to think of it, there is not really a solution for this. However, it can be prevented with comprehensive training that makes the agent really good with the software tools being used.

5. Training for scale? Train for compliance too.

According to John, “You don’t have a mature compliance management system unless you have compliance training processes in place”. While putting a robust and streamlined compliance management process is needed, training the agents and executives for the process is equally important.

Like any other training program, the “same program suits all” philosophy can prove out to be counterproductive. A mature compliance management system is incomplete without tailored programs and training content for various roles. To do this, thorough and well-planned learning management systems need to feature in your compliance management system.

So, we discussed the importance of effective document control, tracking the right KPIs, a streamlined compliance management system, training of collection agents, and compliance training. Increasing market share and boosting profitability is anything but straight forward.

Mere implementation of modern technologies without thorough training and thought out processes will not cut it. Collection agencies and law firms need to have a two-pronged approach about this – adding tools and software to improve efficiency, and training the teams to use those tools effectively.

So are you interested in scaling your organization? Implement good processes and better technology today!