Infographic: Insights From Our Analysis of CFPB Complaint Data

- October 22, 2021

- Category: Compliance Management

Recommended Reading

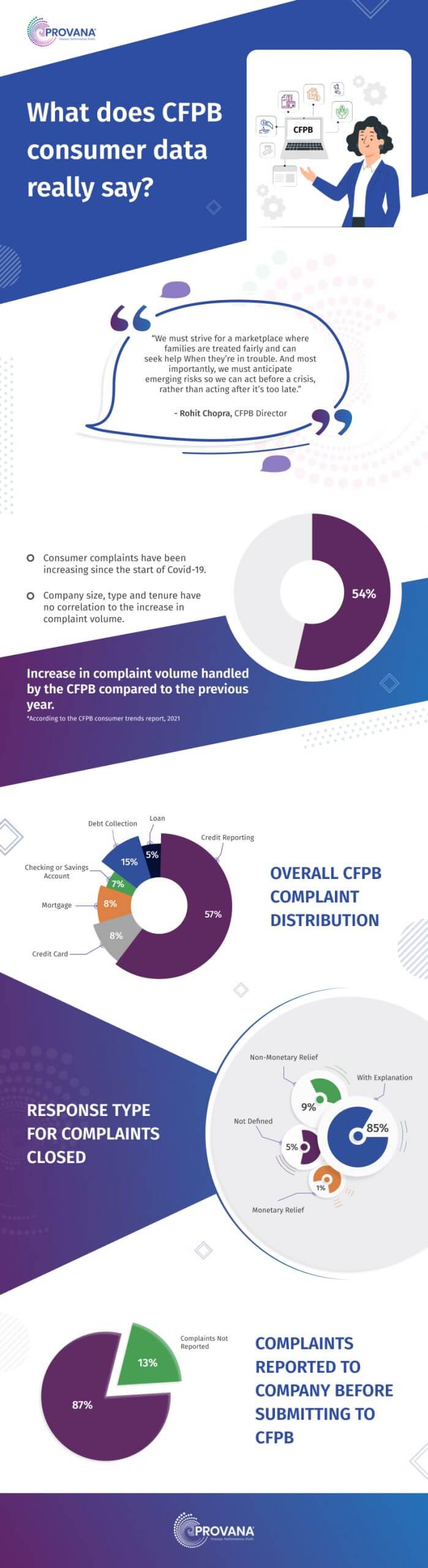

CFPB complaint data is a great way to identify trends and gather insights into what is happening in the credit and collection space. But the sheer volume of data can sometimes make it difficult to understand what’s really there.

As an industry leader, we regularly analyze the CFPB database to stay updated on industry developments and customer preferences to identify opportunities to better our products and solutions. Below are the findings from our most recent CFPB analysis.

What’s our takeaway? CFPB complaint data indicate a strong correlation between Covid-19 and the need for technology to cope with the changes due to the pandemic.

- Collection efforts are on the rise, but collection revenue is decreasing.

- Companies are struggling to enforce compliance practices due to remote working.

- Companies are not able to give satisfactory responses to their complaints. Therefore, consumers are contacting bureaus for resolution.

- Use technology to create compliance procedures, enforce governance & gain visibility.

- Companies must move away from conventional collection calls & make use of digital communication mediums like email, text, etc. to contact customers.

If you are looking to automate your compliance processes, get ahead of complaints or resolve them faster, Provana can help. Our Automated Compliance Management System, IPACS helps you keep up with ever-changing regulations and ensure your team is trained on the latest policies and procedures. As always, drop us a line to learn more!