Tax Season is here – Are your collections the best they can be?

- December 16, 2019

- Category: Agent Performance

Recommended Reading

Collectors love few things more than tax season. The reason is obvious: when people receive refunds, they’re highly likely to use the extra cash to pay off their existing debts.

There is no crying in baseball tax season.

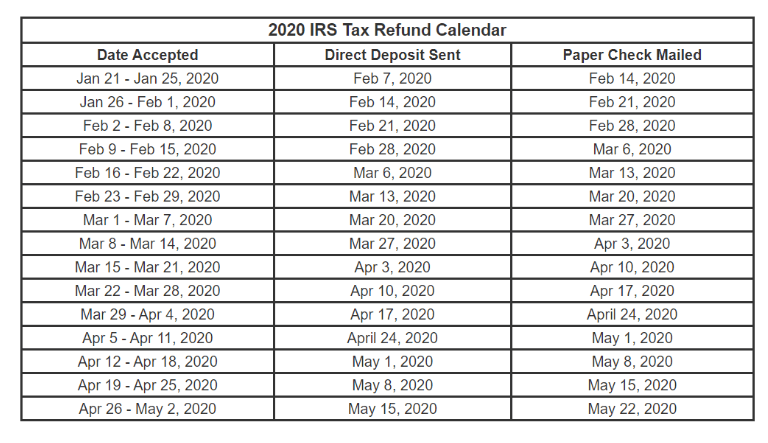

Beginning February, tax season starts in full swing and is traditionally a very profitable time for collection firms. If you’re a collection agency and law firm looking to plan your tax season strategy – look no further than this calendar:

*tentative dates

If you’ve paid close attention to the dates, you would realize that payments are expected to come earlier than the last 2 years.

As a collection firm or agency, you’d be remiss if you don’t have a strategy in place to leverage this window. Consumers typically have more cash than usual at this time, so they may be more active in reaching out to offer resolution options. Don’t leave any opportunity on the table – especially when the consumer is initiating resolution.

If you don’t already have a strategy in place, here’s how you can make the most of the tax season:

- Omnichannel is key: What collection agencies and firms should realize that they’re really in the business of “communication” and this communication business is entirely consumer-driven. The consumer wants to communicate in their way and on their time.

As of 2019 83% of consumers prefer to pay bills online through a wide variety of devices yet over 50% of collection agencies reported that online payments amounted for less than 15% of their revenue.

This is a big whitespace for traditional agencies and firms to grow into. Using self-service apps like IConnect247, allow your consumers the convenience to easily initiate and resolve existing debts – whether it is through your website (through a white-labelled payment portal), or mobile.

If you don’t already have a strategy in place, here’s how you can make the most of the tax season:

- Make every agent your best one: In the collection industry, all that matters is how many deals your agents are able to close. This is in direct relation to the number of calls that your agents make.

Speech Analytics solutions like ICAP provide stakeholders with effective productivity analysis, with measures such as the average call times, silence analysis, or times of maximum activity, and then uses this information to identify areas where agents can be coached to increase performance.

Over time, progress being made can also be tracked, helping firms identify opportunity areas where efficiency can be boosted. Low hanging fruits can thus be identified easily, and ICAP can also assist you on how to give them a shot.

Successful calls are identified and analyzed separately, then the directed feedback is passed to the concerned parties. This boosts agent and collector effectiveness, which ultimately means more business being done.

- In God we trust – others bring data:

Data is the oil of the 21st century – and deservedly so.

Collections operations have historically revolved around quantity, as opposed to quality.

By quantity, we mean the focus on numbers: the number of matters, calls made, or repayment arrangements.

But this strategy makes a false assumption: that all debtors are the same. What if we utilise our data within collections and recoveries to drive our strategy and efficiency.

What if you knew which debtor is more likely to pay (based on history and a variety of other factors), and could prioritize outreach to them?

Beyond predictive analytics and prioritization, readily available real-time scorecards, and KPI matrices allow you to know revenues and contributions from each collector and avenue. You can easily find trends, or look at inventory, and take intelligent business decisions.

“Without big data analytics, companies are blind and deaf, wandering out onto the Web like deer on a freeway.”

– Geoffrey Moore, Author of “Crossing the Chasm” and “Inside the Tornado”

Over time, progress being made can also be tracked, helping firms identify opportunity areas where efficiency can be boosted. Low hanging fruits can thus be identified easily, and ICAP can also assist you on how to give them a shot.

In conclusion...

Don’t just work hard this tax season – work smart. Embrace change and let technology transform your collections. If you’re not sure how to do that, check us out and schedule a consultation.