The Rules of Tax Season – Letting Your Data Work For You

- February 16, 2018

- Category: Collections

With Tax Season now in full swing, we thought it was a great time to talk about Strategy, Return on Investment, and Execution.

From a strategy perspective, on what files should you send an offer? You have all your essential criteria of course, scrubbing out files in a Cease & Desist status, bankruptcy, low balance, and maybe a dozen other critical factors. You’ve made sure that you’ve eliminated any clients of yours who don’t want a letter, claims that are in a closure status, and now you’re ready to apply your Secret Sauce. Some of the most common that we’ll see are Credit Bureau scores, internally generated scores, propensity to pay matrices, and of course good old-fashioned intuition.

A nice clean way to look at your strategy is “Fee Maximization.” To work backwards from a desired Return on Investment number. Let us say for example that you’re looking for a 5x return on your mailing investment. With current mailing rates, you can send around 50,000 letters for about $25,000. You’ll need $125k in fees (probably around $575k in gross collections) to hit your 5x multiple.

Another way to build your strategy is a “Gross Collection Maximization” perspective; this emphasizes end-client dollars remitted over ROI. Why do this? If you’re looking to capture market share and build gross liquidation on your batches, this is the way to go. This is more of a production mindset, where if the anticipated net fees earned on sending one more letter is greater than zero, then you send the letter. The end result of this will be a higher amount of letters sent, greater gross collection dollars, and a potentially lower ROI (though with offsetting advantages).

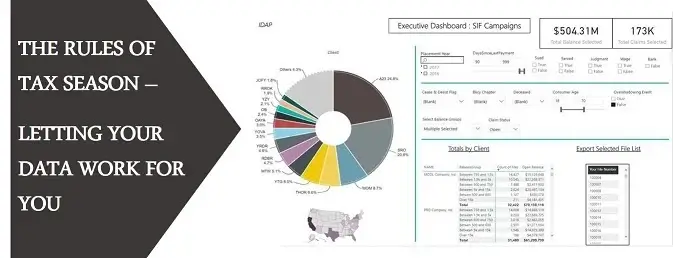

Strategy and ROI bring us down to the only truly important factor: Execution, because without solid execution the other two are quite worthless. In order to support your qualification and selection criteria, you will need a system that supports highly advanced filtering. In many systems, we’ve seen that it is time consuming and challenging to support multi-faceted criteria, including client, claim status, demographics, balances, and all of the other variables needed for a strong decision. Then, you’ll have to repeat the process over and over as you refine your selection list and build your work plan.

Also, key is the ability to gauge your expected ROI based on past results. Without that baseline, your ROI targets will amount to little more than guessing. Many firms will see tax season lifts between 10-20% over typical collections. How can you capture that insight by tracking previous campaigns to actual results? Once you do that, you can build a baseline for expected liquidation and then carve for key criteria like collection score, client, state, and so on. Armed with prior liquidation data, and overlaid with the actual claim counts from your selection phase, you can build a workplan for Fee or Gross Collection maximization.

Need a better way to quick access your data and build your baseline? Check out Provana’s IDAP (Integrated Data Analytics Platform) and learn about the most effective tool for reporting, data analytics, and inventory management.