Compliance Management 101

- August 26, 2019

- Category: Compliance Management

Get started with compliance management with our ultimate guide. Find out how to get started and why compliance management is integral to an organization

What is compliance management?

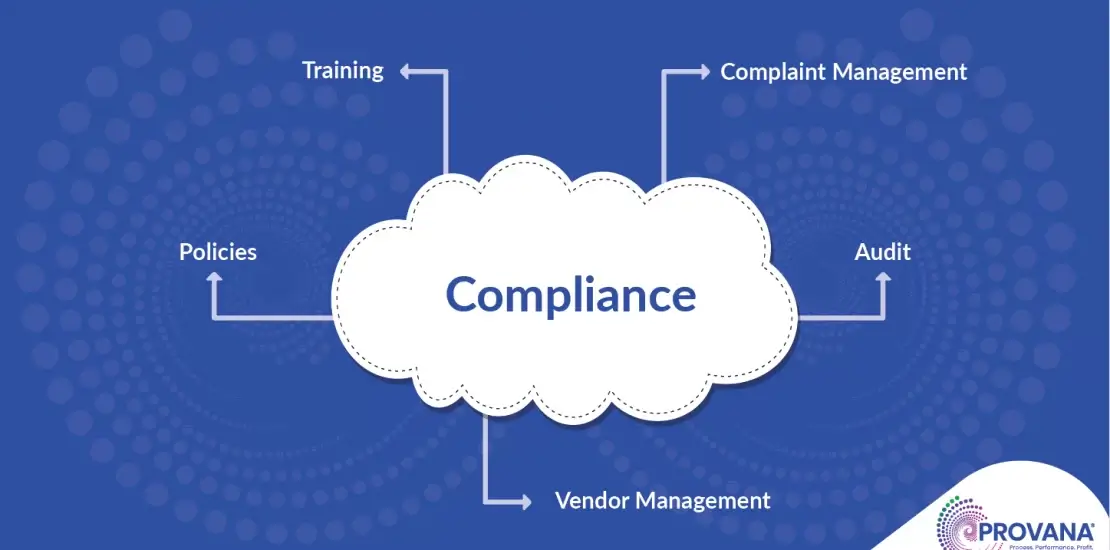

Compliance management is the process by which the management or board of directors ensures that the laws/rules and standards pertaining to the industry are being followed in a company/department.

Compliance management includes activities such as :

Documenting Policies and Procedures

Writing overarching guidelines based on industry best practices that the company and its employees must follow.

Performing Internal audits

Checking internal processes to identify any non-conformance to policies and procedures.

Auditing Third parties

Checking processes performed by third parties to identify any non-conformance to policies governing vendor management.

Compliance training

Ensuring staff members in the company are aware of company’s guidelines.

Why Compliance Management?

Now that we’ve understood what compliance management is, let’s dig into why you should really care about it. Because precaution is better than cure. It’s important to manage compliance effectively to avoid trouble that can potentially harm an organization. There are three main aspects to why compliance management is really carried out.

Law

Data breach

The leakage of data and important information can be dangerous and often leads to loss of trust and also make way for different problems. Focus equally on the compliance along with the development of product and running the business.

Legal actions

According to the Consumer Protection Financial Bureau, nearly every examination or targeted review conducted contains an assessment of an entity’s compliance management system, whether it is an assessment of how the entity manages its compliance program enterprise-wide, or how the entity meets its consumer compliance responsibilities within a specific product line.

The CFPB has found, through supervisory work, that nonbanks are more likely to lack a robust Compliance Management System, as their consumer compliance-related activities have not been subject to examinations at the federal level for compliance with federal consumer financial laws prior to the Bureau’s existence. Lack of effective compliance management has, in a number of instances, resulted in violations of federal consumer financial laws. In these instances, the CFPB expects the institution to implement appropriate corrective action, and in general, both banks and nonbanks have committed to improving their compliance management accordingly.

Internal processes

A good compliance management helps put things into a process, saving time and money, and ensuring smooth functioning across operations.

Management Participation

One of the most important aspects of compliance management is when the board of directors and upper management participate in all of its development processes from the initial stage.

Collaboration and Process

A well crafted out compliance management ensures all the process related to compliance are happening in a streamlined manner from training to documentation. It also allows for all involved parties to be informed at all time. This in turn minimizes the risk of fines, litigation and adverse publicity due to non-compliance.

Capital Partner

While running a business, the goal is always for you to stay competitive. The funding source always looks for evidence of your compliance, that you abide by the rules and regulations, you address consumer complaints promptly and the management/ board of directors makes sure your compliance program is running smoothly. It is always recommended to stay up to date with all of these otherwise you could lose access to the capital keeping you in business.

Getting started with compliance management

First Steps

- Start to find about how similar companies as yours are handling the risks.

- Identify what should be on your compliance checklist.

- Initiate a compliance based risk assessment.

- Ask for external parties help to specialized inputs as needed.

- Train the compliance staff.

- Always keep legal compliance as priority to improve accuracy.

- Conduct compliance auditing periodically.

- Manage the compliance reporting and record keeping.

Strategy

- Take legal compliance as a priority with non negotiable terms, taking it lightly could lead to adverse effects.

- Where the standard is not law, meaning it will not be having strict guidelines to follow can be negotiated.

- Take every precaution possible with in the team and also while outsourcing.

- Evaluate the compliance directives and risks based on products, services, markets and the countries with whom the organization interacts.

- Authorize the lawyers, consultants, insurance and compliance companies for guidance and answering compliance questions.

How compliance management is different for end users and businesses?

While compliance management plays an important role in streamlining processes, it’s viewed differently by different parties involved.

When a business opts for compliance management, its decision makers gets involved in the beginning to have proper clarity, opt for external help of lawyers, consultants etc and most importantly train the employees with all the regulations and laws, especially that are non negotiable.

The management is focused on ensuring that compliance processes are being carried out in a timely and functional manner. A compliance officer uses the compliance management process to ensure all employees adhere to the necessary policies and the corresponding documentation and tracking happens.

As for the team member, who’re being referred to as consumers here, it can sometimes be overwhelming. Because onboarding a compliance management platforms also requires a certain type of culture, the management at times might face some resistance but optimized training and onboarding can help smoothen the process.

Optimizing Compliance Management

A compliance management system allows an institution to learn about the various aspects of compliance management. It allows an institution to:

- Learn about its compliance responsibilities.

- Ensure that employees understand these responsibilities.

- Ensure that requirements are incorporated into business processes.

- Review operations to ensure responsibilities are carried out and requirements are met.

- Takes corrective action and updates materials as necessary.

It is necessary because it helps in managing risk associated with changing product and service offerings. Developments in the marketplace are addressed using new legislations.

IPACS (Integrated Performance Audit and Compliance Software) is a powerful SaaS compliance management software built for your budget. Free to implement, managed by Provana and customized to your needs, IPACS compliance management system automates and centralizes key compliance tasks to help ensure your business adheres to industry regulations and state and client requirements.

IPACS is more tailored towards credit and collection space and the functionalities are much deeper that might benefit small companies a lot.

IPACs compliance management system offers a suite of intelligent features for internal compliance and external compliance.

Internal compliance

IPACS compliance management system’s modular design allows you to adopt the functionality you want, then add more as needed. That a la carte approach, combined with free implementation, makes it possible for any size business to get enterprise-grade technology – and without the need for IT infrastructure and staff.

External compliance

IPACS’ external compliance modules like vendor management software connect you with your vendors, providing intelligent reporting and timely alerts that make it easy to track, manage and maintain oversight of partners and service providers.

Compliance Management in the credit and collections industry

Even though Compliance Management in general implies process that ensures people follow set of rules and regulations, the definition of compliance management changes from industry to industry. Credit and Collections industry is evolving in terms of compliance and companies are in the process of building a robust compliance framework. Some companies do not have a sound overall compliance program while others do not have technology in place to manage the compliance activities. With proposed rule making by CFPB, all eyes are set on what impact will these new rule makings bring to the industry. The landscape requires external thought leaders who can bring knowledge and a better framework to manage compliance to ensure consumer laws like FDCPA are followed and are embedded in every aspect.

Future for compliance management

With ever changing advances in technology and a huge focus on AI, it’s inevitable that AI will play in role in shaping up the way compliance is managed.

Technologies such as robotic process automation that will allow speeding up routine tasks, minimizing human error, text analytics and insights, data extraction, processing unstructured data and identifying the relevancy of content, errors and negative news are the future of the way compliance will be managed.