Navigate Regulation F Updates with Confidence Using the Industry's Most Comprehensive Compliance Management System

- ONLINE CHANNELS : Identify Duplicate Dispute Across Channels

- DIALER : Identify 7-in- 7 Violations

- CALL ANALYTICS : consumer consent and Preference Audits

- SYSTEM OF RECORD : Model Validation Notice Audits

Prepre > Control > Optimize

- Identify risks and take corrective actions

- Centralize & update policies

- Supervised training & testing

- Custom dashboards for Insights

Forget These Common Outsourcing Myths

Save time and money training teams

Integrate with multiple systems

Pull exception reports for audits

REGULATION F WORKBOOK

Navigate Regulation F Updates with Confidence Using the Industry's Most Comprehensive Compliance Management System

Regulation F Workbook

How do you stack up? Get your go-to guide today.

Discover how you can benefit from the industry's most

comprehensive Regulation F compliance solution providing

100% Reg F Coverage

Pull exception reports for audits

Integrate with multiple systems

Save time and money training teams

Drive Productivity, Performance, and Profit with Built-In Analytics

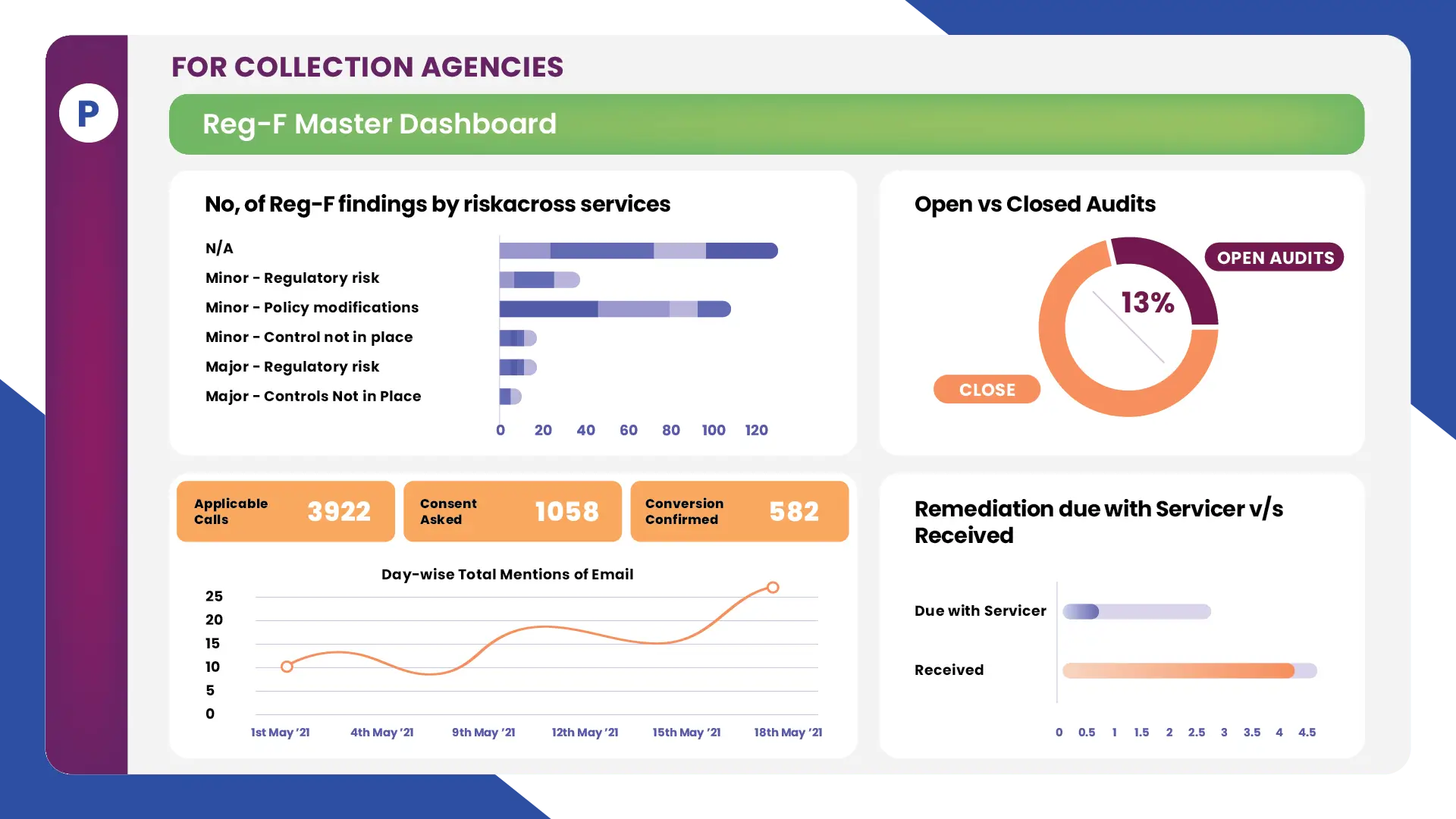

For Collection Agencies

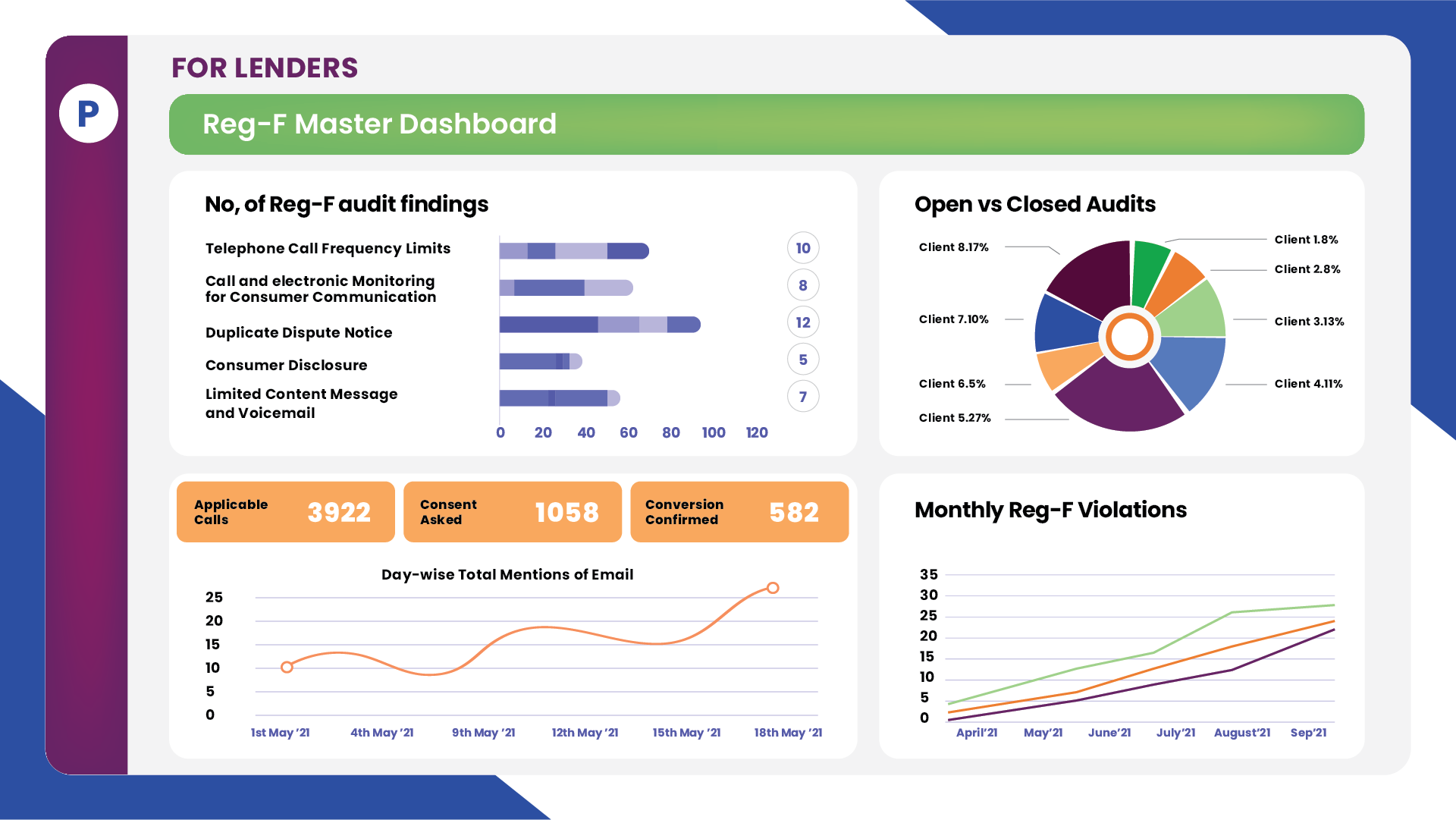

For Lenders

8 Components Of Regulation F Compliance And How To Navigate Them

Managing, communicating, and enforcing all aspects of Regulation F compliance across your firm can be a labor-intensive and error-prone process simply because the new CFPB rule is multi-layered and tricky to navigate. It is naturally hard to keep a track of the policies and procedures mentioned in the rule. This explains why agencies are still figuring out how they should contact consumers, the frequency of contact, disclosures made about time-barred or disputed debt, and the complexity of working with non-English speaking consumers.

Having said that, it is possible to enforce Regulation F compliance in your collection practice effectively and (review your existing processes and internal controls yourself) if you complete the below-mentioned to-dos and approach the audit process with utmost honesty and transparency.

1. Tracking of 7-in-7 compliance

The contact frequency in the Final Rule clarifies that the debt collector cannot place a debt repayment-focused telephone call/text message/email to a person more than seven times within seven days or within seven days after engaging in a telephone/textual conversation with the consumer. The 7-in-7 rule applies to each debt. Therefore, if an agency has three debts for a consumer, they can call a total of 21 times in seven days, seven times for each debt.

Best Practice Tips:

- Track each call attempt, the result of the call attempt, and the person contacted. Note all express consent received from a consumer with the date, time, and instructions for the call-back.

- Track all direct drop voicemails sent, and count toward the “7”.

- Request updated policies in line with the 7-in-7 rule.

- Update your auditing rules to check for email permissible purposes and opt-out tracking.

- Before texting or emailing, gain consent from the consumer. Remember, consent cannot be passed from the creditor.

2. Internal compliance audit for Regulation F

Internal audits are necessary to identify and correct Regulation F non-compliance before they are discovered during an external audit. By establishing a disciplined, integrated approach to Regulation F regulations, policies, risks, controls, and issues, your agency can demonstrate that it has a firm grasp on Regulation F compliance obligations and can provide transparency into overall business risks.

Best Practice Tips:

- Identify areas such as operations, compliance, IT, management, that need a Regulation F audit.

- Alert departments of scheduled audits so they can prepare the necessary documents and materials for the auditor.

- Document internal controls to identify any possible risks associated with the new Debt Collection Rules.

- Review your existing policies, procedures, and other documentation to check if they comply with Regulation F.

- Perform a comprehensive gap analysis to help ensure internal policies, procedures and controls are in place to avoid violations of the Debt Collection Rules.

- Prepare an Assessment Report which outlines the internal controls already in place to help ensure Regulation F compliance and recommendations for modifications to existing internal controls to mitigate transactional, credit, compliance, strategic, legal, vendor concentration, and IT risks.

3. Employee training

A good Regulation F compliance training program can help your agency follow the rule, reduce liability risks, and operate effectively. The best way to ensure and demonstrate that your agents understand Regulation F and other CFPB regulations is to train and test them.

Best Practice Tips:

- Sketch out a plan to start training your QA staff and collectors on regulation F.

- Retrain all consumer-facing agents to actively listen and learn new probing questions.

- Encourage collaboration between compliance and training departments so they can work on online training modules together to make them accessible to your agents.

- Actively track the completion of agent certifications.

- Create a schedule to inspect and test if all the agents are complying with the policies mentioned in Regulation F.

4. Dispute management automation as per Regulation F rules

Automation of dispute resolution that syncs with Regulation F can reduce the average resolution time and unauthorized deductions by up to 30%. The faster and more transparent resolution will help you bring down consumers’ frustration arising from back-and-forth emails and calls.

Best Practice Tips:

- Check with your CTO to know how can AI, ML, and OCR technologies help you automate your dispute management.

- Switch to a centralized compliance management platform that can help you automate key Regulation F compliance tasks.

5. Centralized Regulation F documents

Managing Regulation F documents and tracking compliance activity can be time-consuming and complex processes. Centralized Regulation F documents can enable you to make changes to policies and procedures and have them disseminated within your business instantly.

Best Practice Tips:

- Consider leveraging technology to help you enforce new policies and centralize key Regulation F compliance documents.

- Automate and centralize key compliance tasks, helping you optimize the manpower and operation costs that would otherwise go into the manual compliance management of the new rule.

6. Special focus on model validation notice

Under Regulation F, debt collectors are required to provide validation information to consumers, either orally or in writing when contacting a consumer about a debt. The rule emphasizes that the written validation information should be delivered via the validation notice. Regulation F includes a debt validation notice template, also known as model validation notice (MVN), with new content and formatting guidelines. Hence, it becomes incredibly important to discuss different elements of MVN and navigate the trickiest pieces of the same.

Best Practice Tips:

- Do not forget to mention mini-Miranda, information about the debt (including debt collector’s name and mailing address, consumer’s name and mailing address, name of the original creditor as of the itemization date, account number, name of the creditor to whom the debt is currently owed, itemization date and amount of debt on the itemization date itemization of the current amount of debt), the current amount of debt, information about consumer protections, consumer-response information (attached in a tear-off format for paper notices) as shown in the template.

- Only use the model validation notice that is protected by a “safe harbor”.

- Seek an expert’s help if you suspect your version of MVN to be operating outside the safe harbor.

7. Integration with call auditing platform

Before Regulation F, call centers used to be relatively free to contact consumers as many times as desired. A single contact attempt had little value because one missed attempt could be followed by another within the hours mentioned in the CFPB’s rule book. However, now not following the call frequency as per the 7-in-7 rule can escalate into significant threats against business solvency. The simplest solution to the 7-in-7 rule is making one call attempt per day and ensuring it via call auditing platform.

Best Practice Tips:

- Automate routing of calls as per the 7-in-7 rule.

- Work with your speech analytics solutions vendor to display real-time prompts that help agents stay compliant with Regulation F (particularly regarding on-call disclaimers) while speaking to a consumer.

- Figure out ways to find the best time and day to contact each consumer to improve collection yield within the 7-in-7 rule.

8. Vendor Regulation F compliance

Vendors are an extension of your team and mostly have access to your data or tools. When you are operating in a heavily regulated industry of credit and collections, your staffing partner(s), speech analytics vendor, or business intelligence/BI partner isn’t flouting any Regulation F rule. To protect consumer information and client data, consider auditing your vendors very frequently, based on their Regulation F preparedness.

Best Practice Tips:

- Divide a vendor compliance audit into stages, giving each stage about a week to complete.

- Collect documentation from the vendor for the initial review. Review all material, templates, and material guidance on the new regulations thoroughly with the vendor.

- If needed, meet vendor’s personnel remotely or in-person to discuss their Regulation F policies, procedures, and internal controls.

- Integrate your dialer with only business analytics and speech analytics platforms that are Regulation F compliant and highlight violations of the 7-in-7 rule.

Does this feel like too much work?

Provana provides an advanced and unique Software-as-a-Service solution for collection agencies to manage receivables and mitigate compliance risk under Regulation F. Our modular-based platform allows agencies to choose the products they need to create a customized toolset that allows them to increase efficiencies, reduce compliance risk and increase collections under the new rule. Click here to request more information or a demo of our Regulation F offerings.

Want to learn more about Provana's comprehensive Reg F compliance and audit solutions?

Reserve your complementary demo today!